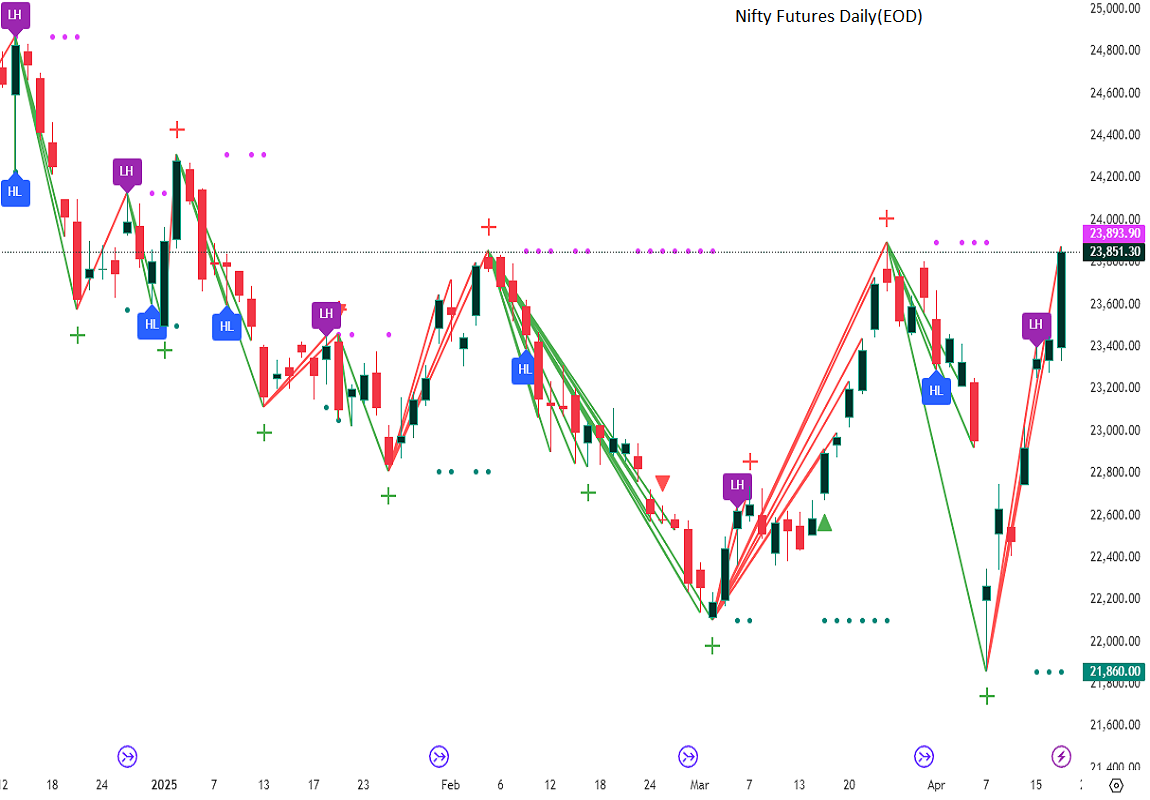

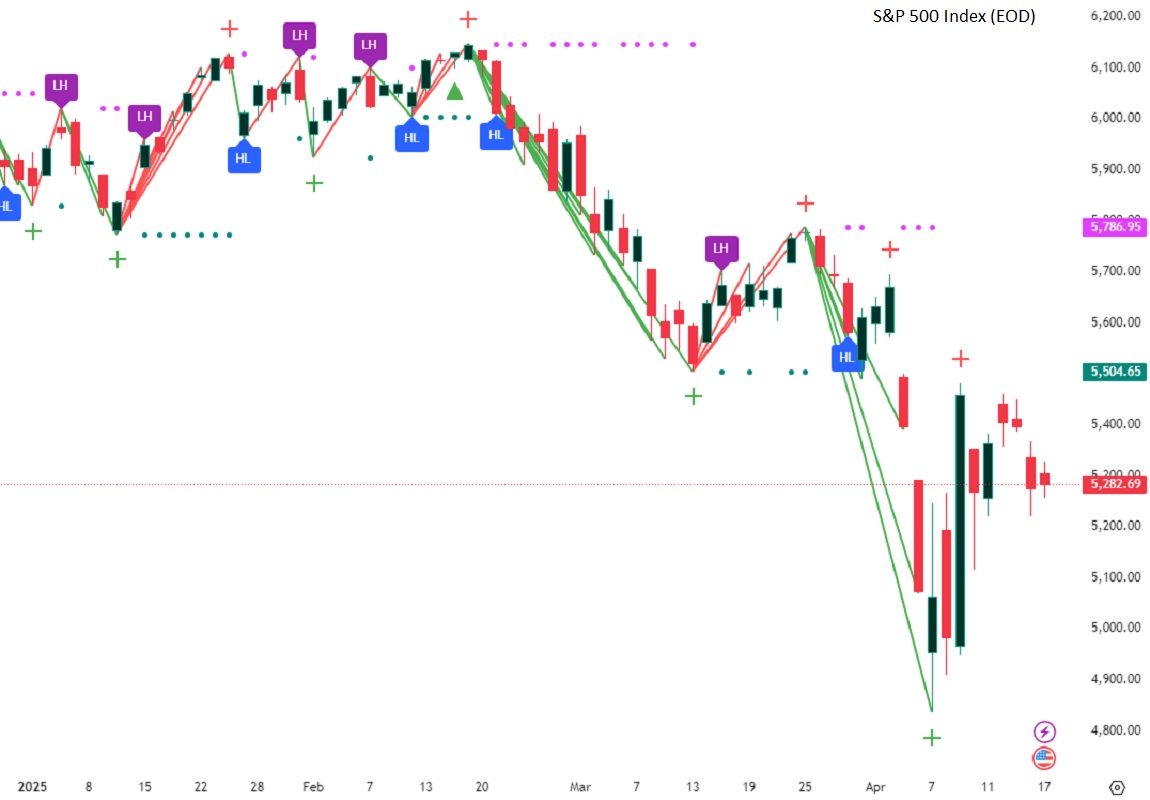

Swing + 3-Bar Breakout

1 / 3

1 / 3

Overview

Swing + 3-Bar Breakout is a hybrid trading tool that combines swing structure detection, momentum filtering, and breakout validation to identify both early trend reversals and confirmed continuations — all within a unified system.

It integrates five key components:

- ZigZag Structural Detection – Finds critical swing highs and lows

- Momentum Validation – Uses RSI and Rate of Change (ROC) for confirmation

- Three-Bar Breakout Logic – Confirms continuation beyond swing structures

- Dynamic Trailing Stops – ATR-based adaptive risk management

- Projected Target Levels – Estimates logical price destinations

What Makes It Unique

This tool doesn’t rely on standalone indicators. It layers multiple checks sequentially and contextually:

Structural Foundation

- Uses a low-depth ZigZag to detect early pivots

Momentum Validation

- RSI and ROC must align with swing direction

- Filters out low-quality pivots during sideways markets

Breakout Confirmation

- Confirms continuation when price breaks 3-bar highs/lows after swing formation

Risk-Managed Progression

- ATR-based trailing stops activate instantly after confirmation

Target Projections

- Projects swing-based price objectives for realistic planning

This creates a dual-purpose system for both swing reversals and breakout entries.

How It Works

Swing Detection

- Swing Low:

- Formed via ZigZag

- RSI < 20 and ROC > +0.5

- Swing High:

- Formed via ZigZag

- RSI > 80 and ROC < -0.5

Breakout Confirmation

- After a swing forms, a secondary signal appears if price breaks above/below the 3-bar structure

Trailing Stop Activation

- On signal confirmation, an ATR-based trailing stop is placed instantly above/below entry

Projection Logic

- Latest swing height is measured

- Projected forward as a visual future target

Who Can Benefit

- Swing Traders – looking for reversal timing

- Scalpers / Intraday Traders – wanting quick momentum confirmation

- Breakout Traders – entering after compression zones

- Risk Managers – using built-in ATR trailing exits

- Price Action Analysts – using projected targets for planning

How to Use

Entry Identification

- Buy Setup: Swing lows backed by positive momentum

- Sell Setup: Swing highs with negative momentum

- Breakout Setup: Confirmed moves beyond 3-bar structures

Manage Risk

- Follow ATR trailing stop plots for active trades

- Watch projected targets for exit planning or scaling

Chart Visibility

- Automatically displays:

- Swing markers

- Breakout signals

- Trailing stops

- Target levels

Disclaimer

This tool is for educational and analytical purposes only.

It does not constitute financial advice.

Trading involves risk, and past performance does not guarantee future results.

Users are responsible for their own decisions.

TradingView Link

To view this indicator on TradingView: Click here